The Impact of U.S. Tariffs on College Students’ Finances and Daily Life

By Singyi Lo

April 7, 2025

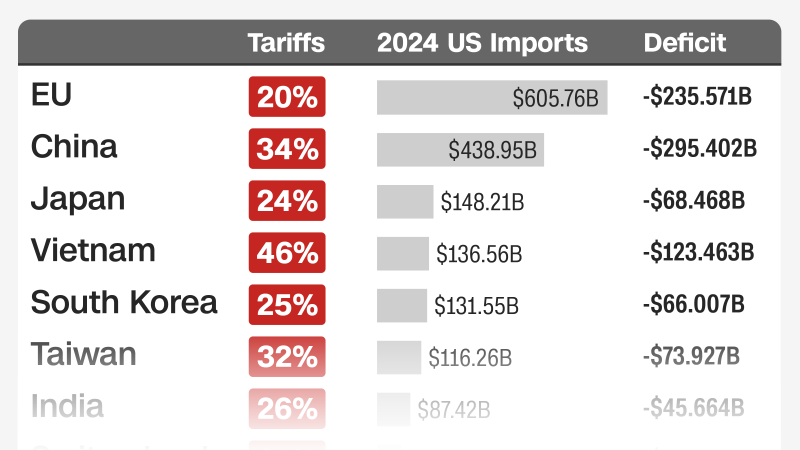

On March 28, 2025, the Associated Press reported that inflation had risen in the previous month, with consumer spending remaining sluggish. This occurred even before the April 2 tariffs took effect, further driving up prices and impacting the financial well-being of Americans.

If you’re feeling as confused as I am, here’s the breakdown: a tariff is a tax imposed on imports or foreign goods entering the U.S. While initially seen as a benefit to American consumers, the reality is that we end up bearing the cost of these tariffs instead.

What about American college students? It’s well known that they already face financial hardships while navigating their academic years. According to an interview in Teen Vogue with Adam Hersh, a senior economist at the Economic Policy Institute, tariffs are expected to drive up prices on everyday essentials. That morning coffee, once $8.00, could soon cost $10.00 due to the additional taxes businesses must pay in response to these tariffs, as The Guardian reports. This added financial strain could make it even harder for students to stay afloat.

The rising costs of imports that contribute to essentials like textbooks, pens, food, and housing could significantly impact students. So, what’s the best solution for working college students? The answer is simple.

It’s important to recognize the power we have in how we spend our money. Establishing a monthly budget allows us to reassess our expenses, distinguishing between necessities and luxury items. A strategic approach, like a once-a-month bulk shopping trip at Costco, could also help maximize savings and make budgeting more effective.

For students unsure where to turn for assistance during challenging times, Metro State University provides support for basic needs and various services, both on and off campus.